Payment security stands at the center of trust in any software-as-a-service (SaaS) platform. Businesses rely on fast, reliable, and safe online transactions to serve customers worldwide. A single breach can destroy that trust and harm a company’s reputation.

This article explores common threats, recommended safeguards, and emerging technologies that shape secure payment processes in the cloud.

Importance of Payment Security in SaaS

Building Customer Trust

Customers share personal and financial details when they subscribe to a SaaS product or service. They expect their data to remain safe from snooping or theft. Secure payment handling reassures them that the provider values privacy and meets modern security standards.

Strong security practices also reinforce the platform’s overall credibility. People prefer services that treat confidential information responsibly. By protecting credit cards, bank details, or online payment credentials, SaaS providers maintain a positive image and encourage continued loyalty.

Regulatory Compliance

Governments and industry bodies enforce strict rules to protect consumer data. For example, PCIDSS (Payment Card Industry Data Security Standard) compels organizations to set strict safeguards around card transactions and storage. When a SaaS product deals with payment information, it must comply with SaaS compliance rules like PCIDSS to avoid legal actions.

Non-compliance does more than risk penalties. It can result in lawsuits, negative publicity, or loss of partnership deals. Meeting regulatory mandates helps companies steer clear of such complications. Timely assessments and strong internal controls also reinforce user confidence, as they signal that the platform follows recognized guidelines.

Common Threats to SaaS Payment Security

Data Breaches

A data breach involves unauthorized access to stored or transmitted information. Hackers may infiltrate cloud databases or intercept data in transit. They can then sell or misuse the exposed details, often causing financial damage and identity theft.

High-profile breaches destroy consumer trust, especially when they impact widely used SaaS applications. These events highlight vulnerabilities like unpatched systems or lax encryption. Once an attack is publicized, customers might leave for competitors with stronger safeguards.

Phishing Attacks

Phishing uses false messages to trick users into revealing login credentials or payment data. Criminals often send emails or text messages that resemble genuine communications from a known SaaS platform.

When users click fake links or open malicious attachments, attackers record the victims’ details. The damage can spread to the entire SaaS environment if criminals take control of administrator privileges. Phishing poses a threat to both individual subscribers and the SaaS provider’s internal team.

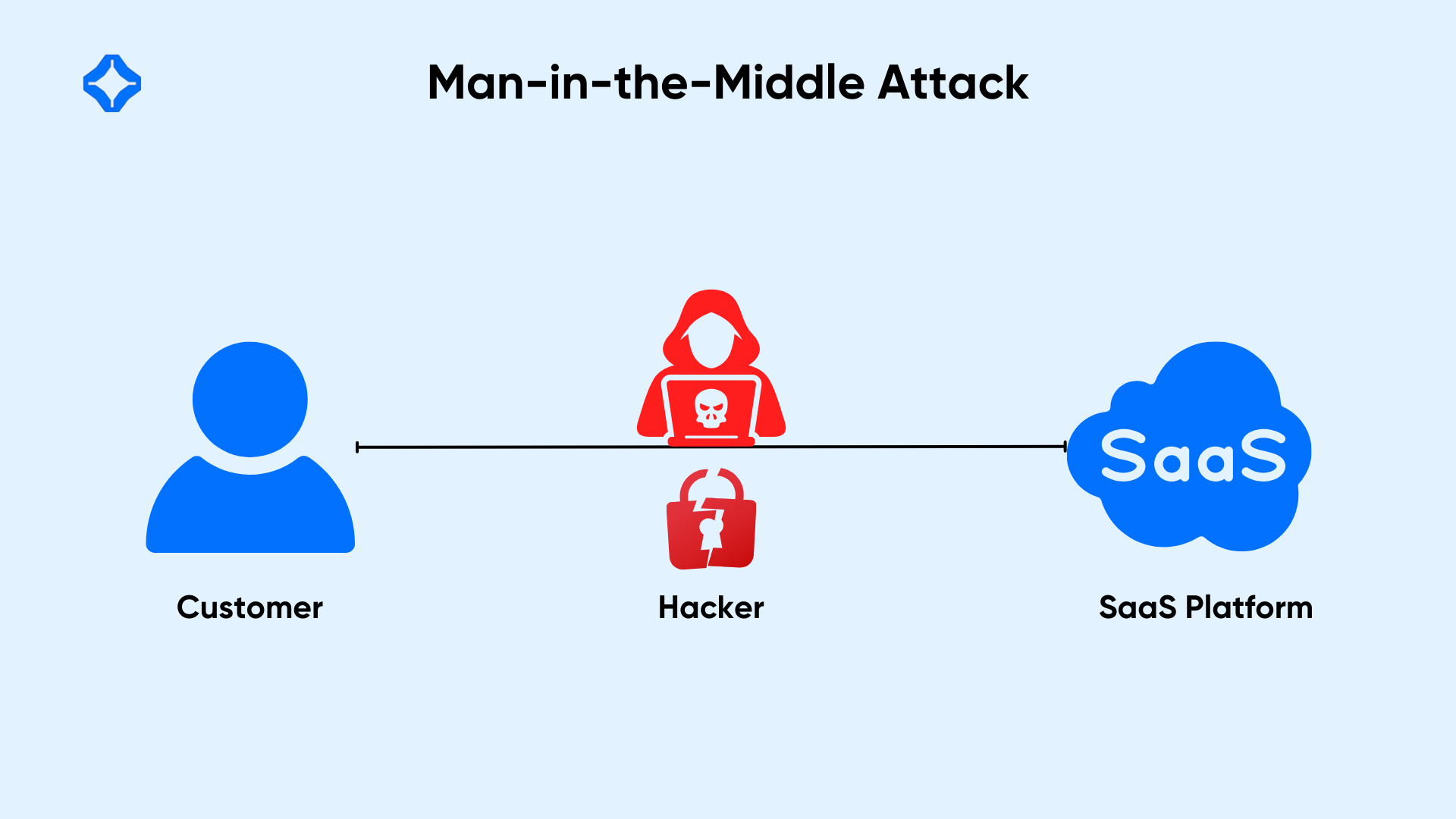

Man-in-the-Middle Attacks

During a man-in-the-middle (MITM) attack, criminals intercept data between two parties. Hackers position themselves between the user and the SaaS platform. They read or alter sensitive data, such as credit card numbers, without either party noticing.

Unencrypted traffic on public Wi-Fi networks is especially vulnerable to MITM attacks. If a SaaS site does not use secure connections, criminals can hijack sessions. This intrusion may lead to stolen payment information, unauthorized charges, or account manipulation.

Best Practices for Securing SaaS Payment Transactions

Data Encryption

Encryption transforms readable data into coded text, which is only deciphered by parties with the correct key. This protection applies to data at rest (stored in databases) and data in transit (sent across networks). Strong algorithms like AES (Advanced Encryption Standard) and TLS (Transport Layer Security) defend payment details.

This step significantly reduces risk if attackers gain access to servers or intercept transmissions. Even if they copy the database, they cannot decode the data without the right encryption keys. Regularly updating protocols ensures that the system resists emerging threats.

Tokenization

Tokenization replaces actual payment details with unique placeholders (tokens). These tokens stand in for the real data during processing. Thus, if hackers breach the system, they find only meaningless identifiers instead of valid account numbers.

This approach limits how far stolen data can be misused. It also allows merchants to store tokens instead of full customer details, shrinking potential exposure. Major payment gateways often offer tokenization as part of their core service.

Strong Authentication Mechanisms

Multi-factor authentication (MFA) requires users to present more than one proof of identity. Common MFA setups include something the user knows (password), something they have (phone or security key), and something they are (biometric data). This extra layer blocks many unauthorized attempts.

Mandatory password resets and guidelines for complex passphrases further reduce account takeover chances. Providers should also monitor login attempts for unusual activity and lock accounts after repeated failures.

Regular Security Audits and Compliance Checks

Hackers constantly find new exploits, so security cannot be a one-time task. SaaS platforms need routine assessments to detect configuration errors or software flaws. Penetration tests simulate real attacks to see if defenses hold up.

These audits should align with PCI DSS requirements and other regulations. By documenting vulnerabilities, teams can fix them promptly. This dedicated approach maintains a strong security measure and meets compliance updates as they become available.

Role of Payment Gateways in Enhancing Security

Secure Payment Processing

Payment gateways specialize in handling transactions on behalf of merchants and software providers. They maintain secure channels and follow rigorous checks that meet industry standards. By routing card information through these gateways, SaaS companies avoid storing sensitive data on their own servers.

This outsourcing lightens the compliance burden for the SaaS provider. It also means the gateway’s dedicated security specialists monitor transactions continuously. If suspicious patterns emerge, the gateway can flag the account or request additional verification.

Fraud Detection and Prevention

Modern gateways use real-time analytics to detect irregular purchase patterns. They may track an unusual number of attempts from a single IP address or notice mismatched billing and shipping details. The system halts these questionable payments and alerts the merchant.

These safeguards adapt themselves over time. Machine learning models can refine fraud detection rules by analyzing large sets of transaction data, so many gateways integrate machine learning SaaS for ongoing protection. This automated protection helps merchants keep losses minimal.

Educating Users on Payment Security

User Awareness Programs

Many breaches occur due to human error. Educating customers is vital, especially when they must protect account credentials or avoid phishing traps. SaaS providers can share simple guidelines, such as never clicking unknown links or giving out passwords.

Tutorials or warning messages at login can remind users about safe payment behaviors. Some platforms send newsletters that detail recent phishing attempts or highlight new security measures. Informed customers can become strong allies against fraud.

Transparent Communication

Trust grows on honest news updates. If there is an ongoing threat or a successful breach, prompt disclosures help users respond. They can change passwords or watch for suspicious bank charges.

Clear channels for reporting suspicious links or messages also matter. When customers spot a potential threat, they can notify support. The team investigates quickly, shutting down malicious sites or blocking harmful email addresses.

Handling Failed Payments and Disputes

Reducing Payment Failures

Recurring payments can fail for a variety of reasons, including expired cards or limits reached. SaaS platforms should send timely reminders to prompt users to update payment details.

Offering multiple payment methods also lowers decline rates. By monitoring each transaction, teams can quickly spot trends in failed payments and fix issues before they grow.

Managing Chargebacks and Disputes

Excessive chargebacks hurt a platform’s reputation and raise processing fees. Clear billing statements and transparent refund policies help prevent misunderstandings.

Automated dispute resolution tools confirm transaction details and validate user identities. These solutions streamline case reviews, minimizing financial losses from fraudulent claims.

Incident Response: What to Do in Case of a Payment Breach

Detecting a Security Breach

Real-time alerts help detect strange activity, such as rapid transaction attempts or unusual purchase patterns. AI-based monitoring can flag fraud triggers that might escape manual checks.

Once the system identifies a possible breach, the security team investigates logs and user sessions to confirm suspicious actions.

Steps to Contain and Resolve Breaches

Start by isolating affected systems, restricting unauthorized access, and changing compromised credentials. Prompt notices to impacted users reduce confusion and allow them to secure their accounts.

Contact relevant authorities or regulatory bodies if required. Detailed post-incident reviews help improve future defenses and reassure customers about ongoing safety measures.

Future Trends in SaaS Payment Security

Adoption of Artificial Intelligence and Machine Learning

AI and machine learning can refine fraud detection by spotting micro changes. These technologies sift through large transaction volumes, identifying small anomalies that may hint at criminal activity. They also adapt as new scam methods appear.

Predictive analytics help SaaS providers act before an actual breach occurs. If the system flags behavior that deviates sharply from a user’s history, it can trigger a forced re-authentication or pause the transaction. This approach moves security from reactive to proactive.

Blockchain Technology

Blockchain records transactions on a distributed ledger. Each block of data is linked through cryptography, making it difficult to alter past entries. This approach promises transparent and tamper-resistant recordkeeping.

In payments, blockchain could cut out intermediaries and reduce processing fees. However, integrating blockchain into SaaS platforms can be challenging. Compatibility with existing payment networks and regulatory acceptance remains in the early stages. Providers must weigh these challenges against the potential for secure, traceable transactions.

Conclusion

Secure payment systems build trust in SaaS products. Businesses must protect sensitive transactions if they want to retain loyal customers and maintain a strong reputation. Strategies like encryption, tokenization, and multi-factor authentication help safeguard user data. Meanwhile, partnering with reputable payment gateways and conducting regular audits adds another layer of defense.

Prioritizing payment security is not only about reducing fraud. It also ensures the platform meets compliance rules and retains user trust. By educating customers on safe practices and staying prepared for new threats, SaaS providers can deliver a secure environment. In an era where digital commerce grows rapidly, strong payment security sets the foundation for lasting success.

FAQs

SaaS payment security refers to the measures and technologies used to protect online transactions, ensuring that sensitive financial data remains safe from fraud and cyber threats.

SaaS platforms use encryption, tokenization, two-factor authentication (2FA), and compliance with security standards like PCI-DSS to safeguard transactions and prevent unauthorized access.

Common threats include data breaches, phishing attacks, card fraud, man-in-the-middle attacks, and ransomware targeting financial transactions and stored payment data.

Tokenization replaces sensitive payment details with a unique identifier (token), reducing the risk of exposing actual financial data during transactions.